With the turbulence of our world today, managing and minimizing risk has never been more important. The pressure to ensure the right protocols are followed—by everyone, all the time, regardless of scenario—is tremendous. Corporate reputations are at risk, the safety of people and assets is vulnerable, and customers are increasingly intolerant of any corporate misstep.

It’s for reasons like these that risk management departments are an increasingly critical part of many organizational structures today. Their goal is to reduce risks and optimize compliance in order to minimize any negative impact on the organization, its employees, or its patrons. Risk management teams work to identify risks, and to deploy training and procedural changes to mitigate these risks. Finally, they work to monitor and analyze processes and changes for the purpose of continuous improvement.

These tasks are not simple and the stakes are high, which is why picking a risk management software solution to facilitate, automate, and optimize these processes is of the utmost importance. But with so many considerations, it is difficult to pinpoint where to begin your search. Utilize the brief guide below to set you on the path to choosing the right risk management solution for your company.

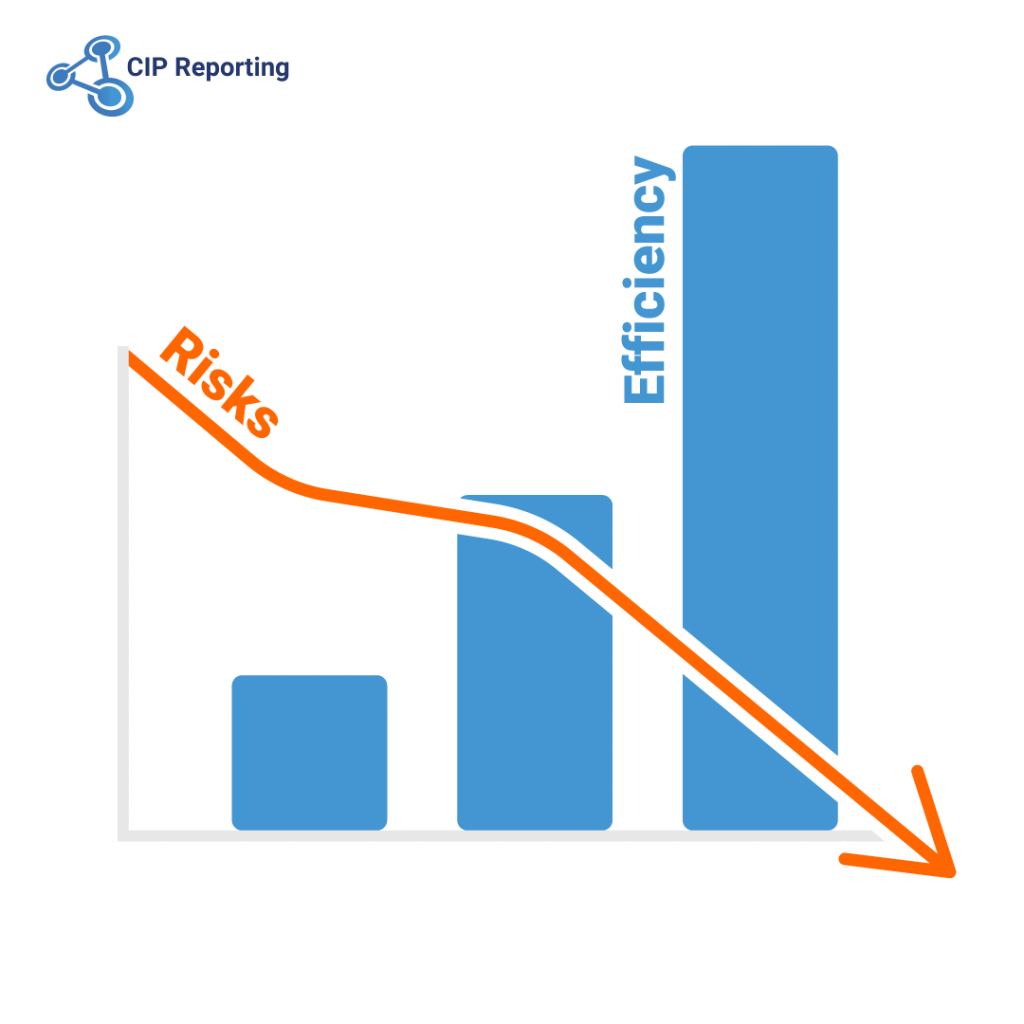

Does the solution offer the tools you need to improve efficiency?

Mitigating risk, especially at a grand scale, is only as effective as the systems in place to track and analyze incidents. Therefore, it is crucial that your risk management software provider has the tools in place that allow users to streamline reporting, logging, and other processes. As you shop around for a risk management solution, keep these three efficiency markers in mind:

- Automation: Offloading the manual labor and energy typically required of staff reduces the number of human errors and creates a system where everyone’s work is complete and compliant.

- Centralization: Moving all risk-related operations under one hub ensures that you have all the information you need to easily oversee team performance and make swift improvements

- Configurability: Aligning risk management software within your existing workflows and communications means team members have less hurdles to clear to start implementing smart risk systems right away.

Does the solution support a culture of reporting

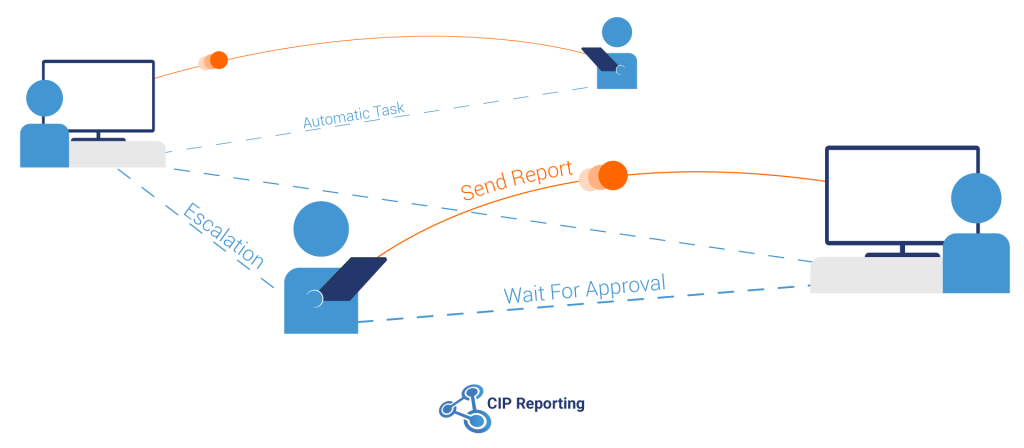

Risk management starts with your staff. Creating an environment where employees have easy directives to follow the right protocols is the best way to ensure compliance. That is why it pays to make sure your risk management software makes it easy for teams to report, log, and navigate incidents. At CIP Reporting, we do this through:

- Easy-to-use interfaces: Our clean, straightforward platform is simple and practical. No matter the role using our solution, from customer care representatives to security administrators, CIP Reporting creates a foolproof experience for users.

- Mobile access: We offer web, desktop, and mobile access to ensure productivity no matters where you go and encourage active reporting and logging no matter where you are working or which device you are using.

- Automatic workflows: With CIP Reporting, team members do not have to worry about next steps and escalations. Our flexible and intuitive workflows give staff the prompts they need to complete tasks, flag items, and create notifications.

What kind of visibility into your company’s operations will you gain with this software?

While several risk management providers may offer the means to log and track incidents, an even greater consideration is choosing a solution that will provide insight into your operations. A comprehensive risk management solution will help you obtain a complete understanding the changes that can be made to improve efficiency and reduce further risk through tools such as:

- Search functionality: With the ability to instantly search, recall, report, and analyze incidents, companies need thorough discovery tools to access all aspects of risk data.

- Custom reporting and executive dashboards: Because several types of roles use risk management software, companies should prioritize custom reporting and executive dashboards in their search, which allows you to see and share the information most relevant to their needs.

- Detailed analytics: Real-time insights into team performance and response is one of the main barriers to successful risk management. Make sure to choose a solution that enables you to identify trends, issues, and procedural gaps.

Does the software integrate with your other systems?

Implementing a risk management solution that works in opposition with your existing processes and providers will only exacerbate the strain on staff to manage incidents accurately and efficiently. Companies should not overlook the importance of integration when searching for a risk management provider.

CIP Reporting’s solution is designed to easily integrate with the software and hardware essential to your processes. Our integration is just one of the ways we help customers achieve efficiency while reducing risk and remaining compliant.

How flexible is your software to account for future growth?

With so many providers in the risk management market, it makes sense to partner with a company for the long-haul. Ensuring you will not outgrow your solution means selecting a company that can offer:

- Scalability: Whether working within one department or managing risk across many, choose a solution that serves you for now and prepares you for later.

- Configurability: Workflows change, and your risk management provider should be equipped to change with you. At CIP Reporting, we focus on your process, not ours – meaning that each field and question is directly applicable to your approach.

Whether you have just begun for search for risk management software or are in the midst of various demos, keep this checklist handy to be sure your provider can meet your needs. CIP Reporting handles all this – and more.

Request a demo today to discover how we help you protect the things that matter most.