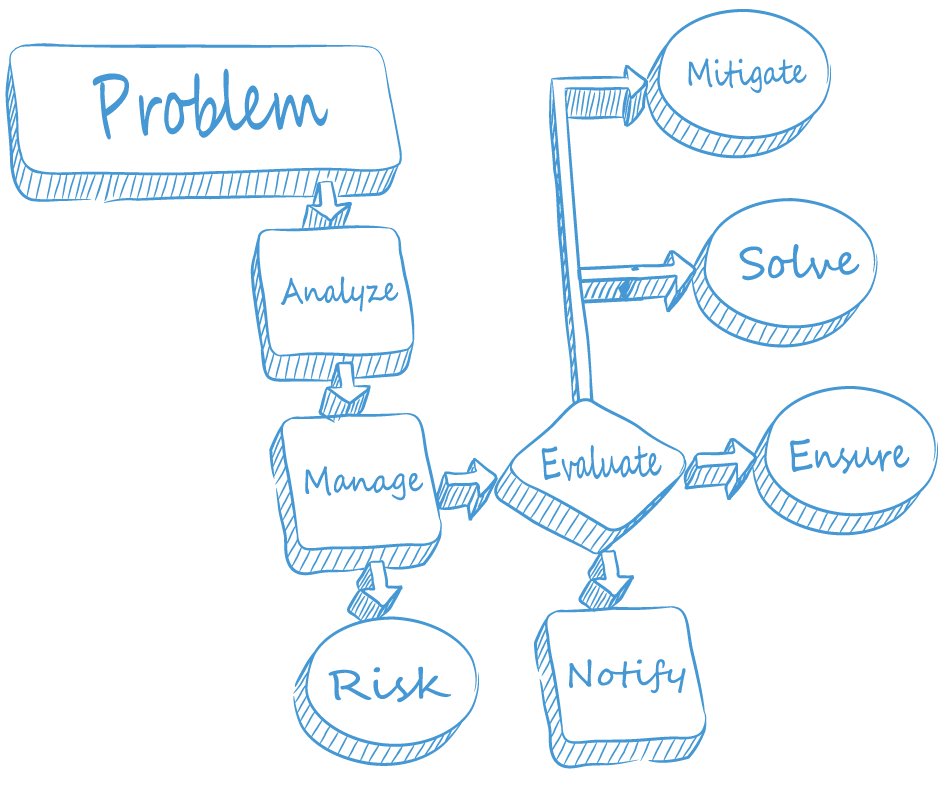

Our highly-configurable solution automates, documents, reports, and analyzes risk management processes, so you’re prepared to take on the risks of today’s dynamic industries.

Our highly-configurable solution automates, documents, reports, and analyzes risk management processes, so you’re prepared to take on the risks of today’s dynamic industries.

CIP Reporting eliminates manual, paper-based processes, which lowers the risk of errors and ensures the work is always correct.

Automated, built-in workflow logic means that your team is always following the precise right steps and can do so quickly and efficiently.

Our central, flexible, and scalable platform design makes adapting to change in requirements or procedures straightforward.

Detailed views into the documentation, history, and trends surrounding your business enables complete, real-time visibility into your operations.

The choice between web, desktop, and mobile access ensures top productivity regardless of where you’re working or which device you’re using.

CIP Reporting’s reports, logs, and analytics provide the data insights required to prove your team’s ongoing effort, impact, and growth.

CIP Reporting eliminates manual, paper-based processes, which lowers the risk of errors and ensures the work is always correct.

Automated, built-in workflow logic means that your team is always following the precise right steps and can do so quickly and efficiently.

Our central, flexible, and scalable platform design makes adapting to changes in requirements or procedures straightforward.

Detailed views into the documentation, history, and trends surrounding your business enables complete, real-time visibility into your operations.

The choice between web, desktop, and mobile access ensures top productivity regardless of where you’re working or which device you’re using.

CIP Reporting’s reports, logs, and analytics provide the data insights required to prove your team’s ongoing effort, impact, and growth.

Offers a streamlined and integrated approach to compliance that facilitates the step-by-step inspections, audits, and investigations based on your predefined procedures.

Automates the incident reporting process so you can rest assured your team is consistently and effectively working according to your precise protocols.

Ensures you’re effectively positioned to document and report the issue, identify the root cause, and implement corrective actions.

Revolutionizes the end-to-end license issuance process.

Offering a streamlined and integrated approach to compliance that facilitates the step-by-step inspections, audits, and investigations based on your predefined procedures.

Ensures you’re effectively positioned to document and report the issue, identify the root cause, and implement corrective actions.

Automates the incident reporting process so you can rest assured your team is consistently and effectively working according to your precise protocols.

Revolutionizes the end-to-end license issuance process.

“Configurability, built-in notifications, escalations, analytics, and overall customer service made CIP Reporting stand out.”

Joe Schuetz, Security Director at L.A. Live

“I’ve been impressed with CIP Reporting from start to finish. I’ve been impressed with the software, tailored design, training, implementation—all of it. CIP Reporting is truly amazing.”

Jesse Silva, Director of Surveillance for Valley Forge Casino Resort

“We are now consistently compliant with all regulations and laws and can easily report our work effort to management — now that’s success.”

Danielle Brashear, Seneca–Cayuga’s Gaming Commissioner

“CIP Reporting offers us great visibility into the 150-200 incidents we receive each month. Without it, we would not be nearly as effective as we are today. Moving to CIP Reporting was like moving from Fred Flintstone’s era to George Jetson’s.”

Melody Moscal, Integral Care’s Quality Experience Administrator